Payment Processing Solutions for the Hospitality Industry

Our payment processing solutions for hospitality offer several benefits, including reducing chargebacks, enhancing the customer experience, ensuring PCI compliance, and all of this is achieved at a minimal deployment and running cost.

Key features and Benefits of Hospitality Payment Processing

Access PaySuite’s payment processing software solutions for the hospitality industry offer several key features and benefits that can greatly enhance operations and deliver significant value to all types of businesses in the hospitality sector.

Let your customers pay the way that they want to

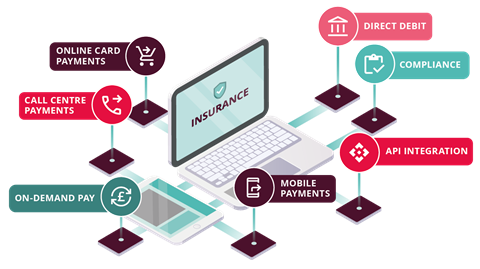

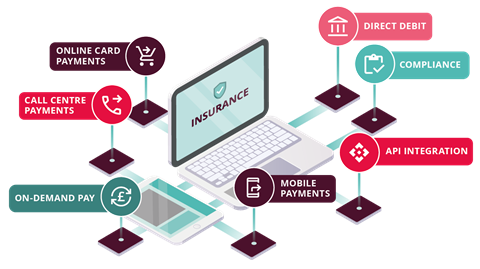

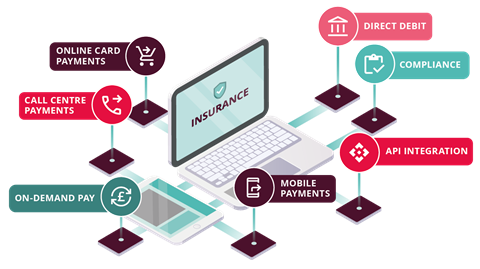

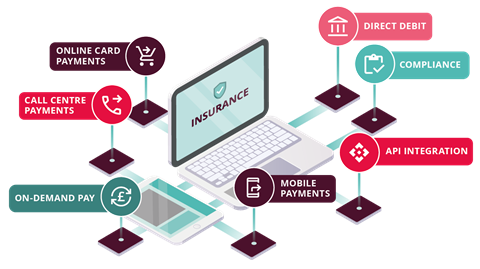

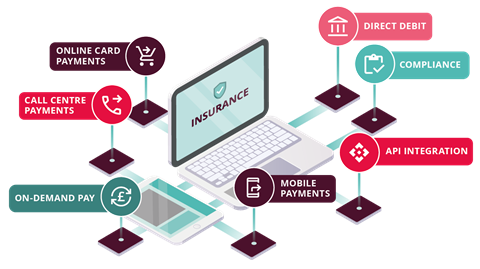

Our hospitality payment solutions empower businesses to accept a wide range of payment methods, such as credit cards, debit cards, direct debit, mobile payments, online payments, phone payments and face to face payments.

A mobile-first approach

Hotel operators need to ensure that when it comes to convenience, they’re offering their customers fast and easy payment methods. That’s why our hospitality payment solutions use mobile responsive payment pages combined with a customer wallet, for fast easy repeat bookings, no matter the device - smartphone, tablet, laptop.

Flexible Telephone Payments

Enhancing security and reducing the risk of handling confidential payment information, our scalable telephone payments solution converts abandoned transactions. With our phone payments solutions, customers can securely enter card details in a PCI-compliant environment, eliminating the need for phone operators to handle sensitive card data.

Face-to-Face and Contactless Payment Solutions

Embrace the latest technology with our face-to-face and contactless payment solutions. Customers can securely pay using Apple Pay, Samsung Pay, and more, whether at the counter or on the go with our Mobile Point of Sale (MPOS) solutions.

If you’re aiming to simplify the check-in and check-out process, manage online reservations, and securely process payments from guests, Access PaySuite’s hospitality payment processing enables you to accept multiple payment options.

This not only streamlines the transaction process but also enhances the overall customer experience.

Easily Integrate with Other Systems

Our hospitality payment processing API seamlessly integrates with other systems used in the hospitality industry, such as point-of-sale (POS) systems, hotel property management systems (PMS) and enterprise planning (ERP) systems.

This integration ensures accurate recording and synchronisation of payment information across different platforms, reducing errors and discrepancies.

Manage PCI Burden Across All Payment Channels

Our payment processing software offers enhanced security and fraud prevention, making it the perfect choice for businesses in the hospitality sector.

With robust measures like encryption and tokenisation, we ensure the utmost security for sensitive customer data, guaranteeing secure transmission and storage of payment information.

Our payment solutions prioritise compliance with the Payment Card Industry Data Security Standard (PCI DSS), reducing the risk of data breaches and ensuring secure payment transactions.

Whether you're accepting payments at the front desk, managing online reservations, or facilitating mobile payments, our software ensures PCI compliance across all channels.

Preserve Your Brand Identity Across All Integrations

Image is crucial for all hospitality businesses, including in payment processing. We offer tools for a seamless payment experience and secure handling of card data. Regardless of the integration you choose, we can ensure the ability to brand your business uniquely by offering flexible terms and customisable features. This flexibility ensures a seamless payment experience aligned with the brand and customer expectations.

Reduce Chargebacks and Protect Your Hospitality Business

Chargebacks can be costly and time-consuming, with ambiguous query codes and a short window to respond. In an industry that offers credit before service, protecting transactions is crucial. Our payment solutions minimize chargebacks by implementing robust payment processing systems, reducing costs and inconveniences.

Simple, affordable pricing

No set-up fee and transaction fees as low as 4p. Customised packages available for businesses with large payments volume.

Every payment made easy

As the experts, we’re on hand to help you manage your payments across our range of hassle-free solutions.

Online Card Payments

Get paid online from any device and simplify transactions, giving your customers a simple, seamless online card payment experience.

Online Card PaymentsDirect Debit

Keep track of recurring payments, simplify subscription models, and eliminate the risk of failed collections, using our industry-leading direct debit platform for insurance companies.

Direct Debit PaymentsEmbedded Payments

Connect with your existing internal systems & software using our API integrations, for seamless financial experiences and insights at a glance.

Embedded PaymentsOn-Demand Pay

Engage your workforce and reduce staff turnover by giving employees instant access to their pay with Access EarlyPay.

On-Demand PaymentsDirect Credit

Take full control and make your outgoing payment transfers accurately and efficiently, with one of the most secure and trusted payment methods.

Direct Credit PaymentsReady to start getting paid?

Give your organisation the stability and freedom it needs to drive higher levels of growth by seamlessly automating your payment processes.